Money blog: Two Michelin starred chef picks popular high street chain among best cheap eats

admin

- 0

Why you need to submit a meter reading this week

We’ve been banging on about Monday’s energy price cap change for some time – and for good reason.

The average household bill will drop by £238 a year due to the changes, but some might not get full savings in their April bill unless they take crucial steps.

That involves taking and submitting meter readings by Monday.

(If you have a pre-paid or smart meter, stop reading – you can kick your feet up and relax.)

Why do I need to read my meter?

Energy companies can bill you based on usage estimates. Anyone who has received an outlandish bill before knows these estimates can be inaccurate.

So, taking a reading on or around 1 April ensures any estimates are taken with the correct, lower price cap from that date.

A small note

With so many of us doing the same thing and submitting readings via sites or apps – servers can often crash.

Don’t worry if that happens, as you can backdate meter readings anywhere from five days to two weeks later (check with your provider for details).

1h ago11:01

Oil price falls – in potentially good news for motorists

By Sarah Taaffe-Maguire, business reporter

Some small bit of good news for drivers this morning as the oil price ticked down.

People can expect to see the cost of filling up the tank being a bit cheaper in about 10 days’ time as the price of crude oil trickles down to the pumps.

A barrel of Brent crude oil – the benchmark for pricing – costs $85.37, down from $87 yesterday morning.

The FTSE 100 moved further away from a new high this morning. There had been hopes last week a new record value would be reached.

The best performing company in the index is one most readers are unlikely to have heard of. Diploma’s share price was up 11% to the highest ever level after the products and service distributor said it is to acquire aerospace provider Peerless Aerospace Fastener for £236m.

On the currency markets £1 can buy $1.2634 and equals €1.1657.

2h ago10:37

Barclays apologises to customers over issues with payments

By Sarah Taaffe-Maguire, business reporter

Barclays has apologised after customers experienced difficulties with payments into and out of accounts, as well as with its app, telephone and online banking services.

The problems began last night and continued into this morning before the bank said, just before 6am, everything was working as it should.

But customers responded to the post on X with complaints of wrong balances and missing transactions.

iStock

While balances were showing as reduced or increased there was no transaction into or from the account visible for some customers. Recent transactions weren’t showing at all for an X user who posted just before 8am.

Initial problems with the Barclays app and online banking were said to be fixed late on Tuesday evening but issues with payments into and out of accounts and telephone banking were persisting.

Barclays has not said what the cause of the technical difficulty was.

All problems were fixed overnight, the lender said… “We’re sorry for any issues you faced.

“We really appreciate your patience while we got things back up and running.”

There are more than 20 million Barclays customers in the UK.

2h ago10:11

NHS doctor is told ‘you’re not my mum’ after warning about Easter eggs

An NHS doctor is urging people not to eat a whole Easter egg in one go – leading to a backlash on social media.

Tooth decay, obesity and Type 2 diabetes are all increasing, Dr Andrew Kelso warned as he called for moderation.

But one person replying on social media said they would “eat two now” while someone else wrote: “You’re not my mum.”

A third said “Easter finally has a grinch”, while a fourth asked for “more specific instructions”, wondering whether a Cadbury Creme Egg was included.

Read the full story here…

Do not eat a whole Easter egg in one go, NHS doctor urges

Advertisement

3h ago09:16

Ocado named fastest growing supermarket

Ocado is the fastest growing supermarket, new data from Kantar shows.

The data and analytics company said sales in the 12 weeks to 17 March were 9.5% higher than the same period last year.

Industry figures showed the grocer is growing faster than its rivals thanks to price cuts.

Ocado and rival Waitrose were the only grocers to boost their number of shoppers in the first three months of this year.

Total sales were also shown to have lifted 10.5% to £645.3m in the first quarter of its financial year.

This comes after Marks and Spencer bosses previously expressed disappointment at Ocado’s performance in the years after its £750m tie-up.

Ocado insists it’s ‘aligned’ with M&S – after boss threatened legal action

Hannah Gibson, Ocado Retail CEO, says the supermarket has “stepped up” its efforts to provide “unbeatable choice, unrivalled service and reassuringly good value”.

The Which? monthly survey shows Ocado remains one of the priciest supermarkets for a small shop – but it fares better when you’re getting a full trolley…

5h ago07:53

Two Michelin starred chef picks popular high street chain among favourite cheap eats

Every Wednesday, chefs at Michelin or award-winning restaurants around the UK, plus critics and top bloggers, tell us their favourite places for a cheap meal out wherever they are.

Today, we’ve got one of the UK’s best chefs – Mark Birchall, the chef-patron at two Michelin starred Moor Hall in West Lancashire…

What are your favourite places near you in West Lancashire/Merseyside for a meal for two for less than £40?

Swan fish and chip restaurant, Southport. It’s fresh fish, nice chips, lovely pies!

A great one to visit on a family day out – kids all love it too.

For a cheap burger, Five Guys is consistently great!

Customise your own burger, simple but delicious. Cajun fries are excellent too.

Tell us your go-to cheap eat to cook at home when you have a night in?

Roast a chicken!

Ideally use a really good quality chicken, rub in olive oil, loads of sea salt and back pepper, prepare a simple cous cous, and then add a few lovely Greek style additions.

We go for pitta bread, falafel, tzatziki, hummus and a nice green salad – perfect for a quick and tasty family meal.

Read our previous Michelin chef and blogger recommendations around the UK…

Best restaurants for cheap meals in the UK – as chosen by Michelin chefs

5h ago07:53

New £5,000 deposit mortgage launched – here’s what you should know

A high street lender has launched a £5,000 deposit mortgage – which could offer 99% loans.

The fee-free deal from Yorkshire Building Society can be used on property valued up to £500,000, although it’s not available for new-build properties.

For someone buying a typical first-time buyer property at £200,000, a £5,000 deposit would equate to 2.5% of the purchase price, with the remaining 97.5% being borrowed as a mortgage.

Yorkshire Building Society’s director of mortgages Ben Merritt said the deal could encourage a “level playing field for those who don’t have financial support from their families to fall back on”.

Pre-empting concerns about people borrowing beyond their means, Yorkshire insisted loans would be subject to rigorous credit scoring and affordability checks, and the maximum borrower age at the end of the mortgage term is 70.

Wages have struggled to keep up with soaring house prices in the UK, leaving many would-be first time buyers feeling priced out.

Other lenders have also been making efforts to help people get on the property ladder.

Skipton Building Society offers a “track record” mortgage, which helps renters to make the jump on to the property ladder, potentially with no deposit needed, subject to terms and conditions.

Skipton use borrowers’ records of rental payments to help work out what they may be able to borrow.

What should you consider?

Rachel Springall, a finance expert at Moneyfactscompare.co.uk, said the new Yorkshire Building Society deal will likely be popular with those struggling to save a deposit.

But…

“Anyone who borrows at a higher loan-to-value would be wise to overpay their mortgage whenever they can to gain more equity and aim to reach a lower loan-to-value bracket where cheaper deals could be found when they come to refinance,” she said.

Ms Springall added that buyers should be conscious of potential hikes to their utility bills or the cost of commuting in the months ahead.

5h ago07:52

Minimum wage is ‘single most successful economic policy of generation’ – with £6,000 boost for lowest earners

The minimum wage has raised the pay of the UK’s lowest earners by £6,000 a year, compared with if their earnings had risen in line with typical wages, according to the left-leaning Resolution Foundation.

The thinktank’s analysis suggests the introduction of the policy by Tony Blair’s government in 1999 was the “single most successful economic policy in a generation”.

It has meant those in the lowest paying jobs have seen real wages rise despite wages stagnating more generally.

The thinktank said minimum wage was first introduced at a time of rising pay inequality, but the share of those stuck in low pay has fallen from 22% in 1999 to just 9% in 2023.

The minimum wage is set for another big increase next week, rising from £10.42 to £11.44.

This marks the third-highest annual change in its history.

16h ago20:00

COVID vaccines to be sold at Boots for almost £100

For the first time, COVID-19 jabs will be available on the high street.

Boots has become the first major pharmacy to launch a private vaccination service, with at least 50 stores offering the single-dose Pfizer vaccine.

The shot will be available from 1 April for anyone aged 12 or over – but there’s a hefty price tag.

The vaccine will be priced at £98.95.

Boots has said it is working to make the vaccine more affordable, but the COVID jabs are more expensive to produce than others.

Some people are still eligible to get a booster vaccine for free on the NHS – including those over 65 or with weakened immune systems due to conditions such as cancer.

Advertisement

19h ago17:40

Lidl to increase space for chickens so they can lead ‘good lives’ – after being criticised by animal welfare group

The discount supermarket has said it plans to increase its animal welfare standards by allowing more space for its chickens to roam.

Chickens used in its own-label products will have 20% more space than the industry standard, with a maximum density of 30kg per square metre, Lidl said.

The transition will start this summer and should finish by early next year.

The move will provide chickens with more space to roam, which Lidl said “enables them to engage in natural behaviours like stretching their wings, dust bathing and exploring, bolstering both physical and psychological well-being, leading to more fulfilling lives”.

Lidl GB chief commercial officer Richard Bourns said: “Animal welfare is a priority for us, and we are dedicated to ensuring all animals within our supply chain lead good lives.”

The supermarket was previously criticised by campaign group The Humane League UK, which said it was “very resistant” to making changes on animal welfare.

It had called on Lidl and other supermarkets to sign the Better Chicken Commitment (BCC) – a welfare policy requiring the use of slower-growing breeds, more space, natural light and enrichment, less painful slaughter methods and third-party auditing.

20h ago15:59

Ocado insists it’s ‘aligned’ with M&S – after boss threatened legal action

Partners Ocado and M&S appear to have been involved in a tussle for some weeks, but the former has now insisted they are “absolutely aligned”.

The retailers have been in a dispute after M&S put its final payment for the joint venture on hold, saying the online grocer partnership had failed to meet key performance targets.

M&S was due to pay £190.7m by August, dependent on the venture’s performance against an undisclosed target in the year to November 2023.

PA

Last month, Ocado Group chief executive Tim Steiner said he believed M&S owed a “substantial amount of money” and if a settlement was not agreed it could pursue litigation.

However, Ocado Retail chief executive Hannah Gibson has now insisted conversations are ongoing and it is not impacting day-to-day operations.

Ms Gibson claimed both companies were “working really closely operationally together”.

“They were in a board meeting and there were positive conversations and relationships going on focused on what we’re doing now to grow and improve the business,” she said.

“I think we’re all absolutely aligned.”

22h ago14:42

Smart meters not working properly | Charity collections crackdown | ITV’s Schofield fees | Dragons’ Den star makes plea

Nearly four million smart meters across Great Britain are not working properly, government figures show.

While some 2.7 million meters were not operating in smart mode as of June 2023, that figure increased to 3.98 million by the end of last year, according to data from the Department for Energy Security and Net Zero (DESNZ).

Read more here…

Nearly four million smart meters are faulty, figures show

Fundraisers doing door-to-door collections for charities will be monitored more closely, the Fundraising Regulator has said.

News reports found recruits were being taught pressure-selling tactics, despite the Code of Fundraising Practice warning against putting “undue pressure” on people.

Charities must monitor subcontracting firms carrying out fundraising on their behalf more closely and must ensure fundraisers are given appropriate training.

ITV racked up millions of pounds in legal costs last year as it dealt with the fallout of the Phillip Schofield scandal, according to a report.

The broadcaster paid £24m in legal fees in 2023, some of which were related to a KC review into Schofield’s affair with a young colleague.

The presenter of This Morning stepped down in May last year, saying his relationship with the studio runner was “unwise, but not illegal”.

ITV was cleared of wrongdoing and has denied it paid a settlement to Schofield or his younger colleague.

Phillip SchofieldPA

Dragons’ Den star Theo Paphitis has called on the government to close a tax loophole used by fast fashion giants such as Temu and Shein.

He argued companies are avoiding customs bills in the UK by shipping individual orders directly from countries like China, rather than shipping in bulk to fulfilment centres.

A UK rule means shipments worth less than £135 are exempt from import duties.

23h ago13:37

What is a recession, how does it affect me and what could happen with the economy this year?

Basically, a recession is the decline of a country’s gross domestic product (GDP).

It’s worth explaining a bit more about what GDP is before we get in-depth on recession.

Gross domestic product is the world’s most closely watched economic indicator. It measures how much is produced, how much is spent and how much is earned in an economy over a certain period of time.

When GDP goes up, the economy is considered to be doing well.

When it goes down – negative growth or economic contraction – it’s not doing well.

The most commonly used definition of a recession is when GDP falls for at least two successive three-month periods, or “quarters”.

The Office for National Statistics says the “two quarters” rule has the potential to be misleading, however, as there are other factors that might mean GDP falls for six months that won’t mean an economy is in recession.

But it’s widely used – including by the Bank of England – as a rule of thumb.

Recessions are temporary and part of the economic cycle. If an economic downturn is particularly severe or lasts for a long period of time, it’s known as a depression.

iStock

Why do some people talk about a ‘technical recession’?

You may have heard economists, journalists or statisticians use this phrase before.

As we’ve said above, in the UK a recession is defined as two consecutive quarters of negative economic growth regardless of how deep, wide-ranging and long an economic downturn is.

Some will use the phrase “technical recession” to identify that they’re applying this prescriptive definition of a recession, compared to, say, the US where the National Bureau of Economic Research will consider a broader range of economic indicators, such as unemployment, job vacancies and wage data, before declaring whether the economy is in recession.

What causes a recession?

It’s difficult to determine exactly what causes a recession, as a number of factors can be at play.

They can be triggered by rising interest rates, economic shocks such as that experienced during the COVID pandemic, excess debt in the housing market (2008 crisis) and oversupply of goods and services – among many other things.

What happens during a recession and how would it affect me?

During a recession there’s less money circulating, which can mean job losses, pay cuts, recruitment freezes and businesses shutting up shop.

Getting a mortgage or loan during a recession will prove hard as banks tighten their lending criteria.

It is also likely a recession will not be felt equally across society, with those on benefits, in precarious work or without savings faring worse.

Are we in a recession now?

Figures released by the ONS last month showed the UK slipped into a recession at the end of 2023.

But the economy is set to grow more than expected in 2024, according to the Office for Budget Responsibility – the country’s fiscal watchdog – which is also expecting better economic growth in 2025 than previously forecast.

Andrew Bailey, governor of the Bank of England, also hinted in February that the recession may “already be over”. He told a committee of MPs he believed the downturn would be one of the most shallow recession events of modern times.

Read other entries in our Basically… series:

Basically… Stamp duty

Basically… Non doms

Basically… Fiscal drag

Basically… Capital gains tax

Basically… Marriage allowance

26 Mar12:27

‘Secret’ court for speeding and TV licence offences must end – magistrates

Prosecutions for low level offences such as speeding, truancy and TV licence fee non-payments are usually dealt with behind-closed-doors by the Single Justice Procedure (SJP).

It’s designed to keep the court system efficient and minimise delays to more serious cases in the magistrates’ courts.

But the Magistrates’ Association has intervened to call for a reform of the SJP system, saying “flaws” in the system mean magistrates do not have enough time to consider cases and that it is harming “some of society’s most vulnerable people”.

The association is urging the Ministry of Justice to carry out a 12-point plan, including allowing prosecutors to see all pleas and mitigations beforehand, and letting the sittings be observed by journalists.

Up to 40,000 SJP cases are currently decided in private each month.

News reports say cases prosecuted by the SJP include a 78-year-old with dementia fined for not having car insurance while she was in a care home, a 33-year-old given a £781 legal bill after accidentally failing to pay £4 to the DVLA, and an 85-year-old woman prosecuted for not paying car insurance after suffering a broken neck and being admitted to a care home.

Advertisement

26 Mar11:11

Uber Eats courier receives payout over ‘racist’ AI case

A black Uber Eats courier has been given a payout to end a legal claim in which he alleged he was unfairly blocked from work because the company’s facial recognition app was racist.

Pa Manjang had his courier account suspended after being told security selfie checks he provided had “continued mismatches”.

Couriers need to provide the photo checks at the start of their shifts, but Mr Manjang said he had been asked to take pictures of himself “multiple times a day” because the AI software failed to recognise him.

He told Uber Eats: “Your algorithm, by the looks of things, is racist.”

Reuters

The food delivery app has said its verification process also involves human reviewers.

Mr Manjang was backed by the Equality and Human Rights Commission and the App Drivers and Couriers Union, who funded his case.

Both said they were concerned by the use of AI in this instance, “particularly how it could be used to permanently suspend a driver’s access to the app, depriving them of an income”.

Uber Eats has made a settlement in the case, but reports suggest it accepts no liability.

The company said in a statement to Sky News that the real-time ID check “was not the reason for Mr Manjang’s brief loss of access to his courier account”.

“Our Real Time ID check is designed to help keep everyone who uses our app safe, and includes robust human review to make sure that we’re not making decisions about someone’s livelihood in a vacuum, without oversight,” it said.

26 Mar11:06

FTSE ‘record high’ doesn’t materialise

By Sarah Taaffe-Maguire, business reporter

The possibility of a new record high being reached by the most valuable companies of the Financial Times Stock Exchange (FTSE) 100 has ebbed away.

The index is down slightly (0.06%) this morning, no longer within touching distance of the all-time high in the combined value of the FTSE 100 companies recorded in February last year, as the rally that came late last week receded.

The news that Asos sales fell 18% in the six months to March did nothing to dent the share price – it was up 7.6% but comes after a fall of 90% across the last three years.

Performing well this morning is gambling giant Flutter, the owner of Paddy Power and Betfair brands. Today it announced it is moving its primary stock exchange listing to New York on 31 May, a blow to London. But it also recorded revenue growth of 17.3% in the UK and Ireland as it said its market share grew in the countries.

Oil prices have fallen from the $87 a barrel cost of Monday and now the benchmark Brent crude oil costs $86.8.

A pound buys $1.2647 and €1.1659.

26 Mar09:54

Grocery inflation eases to 4.5% – but chocolate is soaring

Chocolate is among the products placing upwards pressure on grocery inflation in the run-up to Easter, according to closely watched supermarket data.

Kantar Worldpanel, which tracks pricing and market share, reported a further slowing in the pace of price growth across the sector over the four weeks to 17 March.

It said the annual rate for grocery inflation eased to 4.5% – down from the 5.3% figure recorded the previous month.

The report credited price matching guarantees across the industry, as shoppers continue to seek out value amid the wider cost of living crisis that is continuing to damage household spending power despite wage growth firmly outstripping the rate of inflation.

Kantar reported that prices were rising fastest in markets such as sugar confectionery and chocolate confectionery.

Global cocoa prices have nearly doubled so far this year. Heavy rains in West Africa, where most of the world’s cocoa is grown, have hit production.

Things falling fastest include butter, milk and toilet tissues, it found.

You can read more from our business reporter James Sillars here…

Chocolate among items feeding grocery inflation ahead of Easter

26 Mar07:34

Eight things that are going up in price next week – and six major boosts to Britons’ pockets

1 April (next Monday) is nicknamed National Price Hike Day, as it’s when government bodies and private companies traditionally increase the cost of goods and services ahead of the new financial year.

So what can we expect this year?

TV and broadband

BT, EE, Plusnet and Vodafone customers will be charged 7.9% more from April. These companies pin their prices to December’s inflation figure plus 3.9%, which is common practice in the industry.

Virgin Media and O2, which merged in 2021, are upping prices by 8.8%, as they use the retail price index from January plus 3.9%. There are caveats which mean some O2 customers will see prices rise by less than this.

Sky is also implementing price rises, meaning most Sky TV and broadband customers will pay an average of 6.7% more from 1 April.

iStock

Council tax

Most people who live in councils with responsibility for social care in England will see their bills rise by the maximum of 4.99%.

In areas where the councils don’t oversee social care, the rise for most will be 2.99%.

Birmingham City Council, which has declared effective bankruptcy, has been given permission to hike council tax by 21% over two years due to a black hole caused partly by equal pay claims and a botched IT systems rollout.

Council tax has been frozen by the devolved government in Scotland, while rises in Wales range anywhere from 3% to 21%. Northern Ireland uses a rating system instead of council tax, and rises are also expected here.

iStock

TV licence

The annual cost of a standard colour TV licence will rise to £169.50 from 1 April – an increase of £10.50 on the current price of £159 a year.

iStock

Rent for social housing

The CPI rate of inflation in September – 6.7% – is used to determine the yearly rise in rents.

For 2024-25, the limit will be 6.7% plus an additional 1%.

Water

The average household water and sewerage bill in England and Wales will go up by an average of 6% from April.

Water UK said the increases would leave households with an average annual bill of £473.

Car tax

Vehicle excise duty will rise on all but the cleanest new and used cars in April.

Increases are generally calculated in line with the RPI rate of inflation and are expected to be about 6%.

Train fares

Rail fares will rise by 8.7% in April for those in Scotland, after the Scottish government argued previous fare freezes were not sustainable.

For those in England and Wales, fares rose by 4.9% on 3 March.

PA

Stamps

The Royal Mail will raise the price of stamps again as the company struggles with a decline in the number of letters being posted.

The price of a first class and second class stamp will increase by 10p to £1.35 and 85p respectively from 2 April.

It’s not all bad news in April

National insurance

Chancellor Jeremy Hunt announced in the budget earlier this month that the starting rate for NI will change from 10% to 8% from 6 April.

This will benefit 27 million workers, he said, and is worth about £450 a year to an employee on an average salary of £35,000.

NI for two million self-employed workers is also being cut.

Their rate will fall from 8% to 6%. The government says that is worth £350 to a self-employed person earning £28,200.

Child benefit

The amount people can earn before child benefit is reduced or taken away is increasing.

At the moment, people lose 1% of the benefit for every £100 they earn over £50,000. At £60,000, the benefit is cut completely.

From April, the benefit won’t be reduced until one parent earns more than £60,000. And it will only go completely at £80,000.

Benefits

Benefits and tax credits that are linked to inflation will rise by 6.7% in April.

That was the level CPI in September.

For joint claimants over the age of 25, universal credit standard allowances will rise from £578.82 to £617.60 per month.

Pensions

The basic and new state pension will rise by 8.5% in April – to £11,502 a year.

The new state pension is for those reaching state pension age on or after 6 April 2016. It will rise to £221.20 a week – up from £203.85.

Minimum wage

The National Minimum Wage for those 21 and over will rise to £11.44 – an increase of £1.02, or 9.8%.

There are larger percentage increases for younger age groups -as well as a 21.2% rise for apprentices (going up to £6.40).

Energy price cap

From 1 April to 30 June this year the price paid by a typical household that uses electricity and gas will go down to £1,690 a year.

This is £238 a year lower than the price cap between 1 January and 31 March this year.

26 Mar07:33

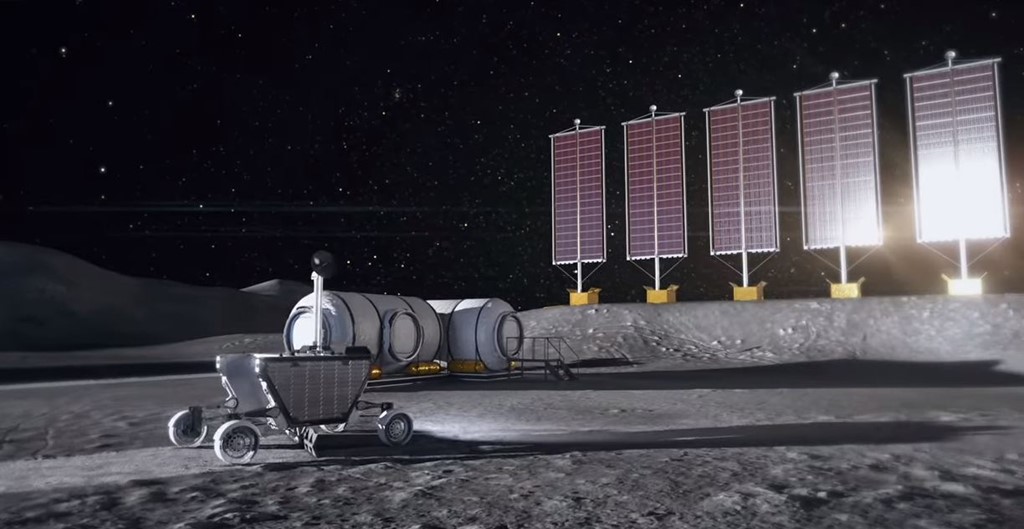

We could see adverts on the moon in the next few years

A lunar rover manufacturer has signed a deal to allow businesses to test and advertise their products on the moon’s surface.

Start-up Astrolab is sending its Flex rover to the moon in 2026 – and has partnered with Group of Humans, a network for creative professionals, to allow the testing and advertising to happen.

Nasa is planning to build a base for a permanent presence on the moon, and it’s said this new deal could provide opportunities such as Volvo introducing a lunar highway code or Nike developing footwear for the low-gravity atmosphere.

An illustration of the Astrolab roverAstrolab

Rob Noble, the founder of Group of Humans, told The Times that his proposal was not particularly new as astronauts wore Omega Speedmaster watches for all six moon landings, and their spacesuits were designed by Prada.

He insisted this new platform would not be used to create gimmicks.

“It isn’t about rubbish stunts to send up Star Trek remains,” he said, referring to the memorial spaceflight service that blasted the ashes of Star Trek creator Gene Roddenberry and several former cast members into space.

“We are focused on making sure that the resources of the moon are cared for and preserved. It’s about really being thoughtful and an awareness that this is going to be really important for mankind. We want to find the companies that really want to change the world.”

Advertisement

25 Mar20:00

NatWest sell-off | SUV drivers could face higher charges | Apple, Meta and Google parent company investigated by EU

The British government is no longer the controlling shareholder in NatWest bank, reducing its stake in the lender to below 30%.

NatWest received several multibillion-pound bailouts at the height of the financial crisis in 2008 and 2009, resulting in the government being left with an 84% stake in what was then known as RBS Group.

The government had been slowly selling down its stake but it accelerated the process in recent months.

Read the full story here…

Government stake in NatWest now under 30%

People who drive SUVs could have to pay higher parking charges in Oxford under plans drawn up by some city councillors.

The motion has been put forward by the city’s Green Party.

It follows a new policy in Paris that saw parking charges triple for SUV drivers.

The Green Party’s plan would have to be approved by the Labour-controlled council.

Reuters

Apple, Meta and Google’s parent company are being investigated by the European Union under new laws designed to clamp down on the market power of the world’s tech giants.

The Digital Markets Act (DMA) came into force at the beginning of March and aims to tackle “gatekeeping” behaviour among tech giants.

If the companies are found guilty of non-compliance, they face fines of up to 10% of their global turnover.

Under the new rules, companies are expected to allow app developers to steer users to products outside their own platforms for no extra charge.

Also, platforms that rank search results must treat all listings fairly and in a way that does not discriminate against services offered by third parties.